south carolina inheritance tax waiver form

Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency. ANDOR NOMINATION ANDOR WAIVER OF BOND.

Lease Agreement Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Formats Like W Lease Agreement Being A Landlord Legal Forms

_____ Decedent I acknowledge that Personal Representatives are required by law to file the following documents prior to the closing of.

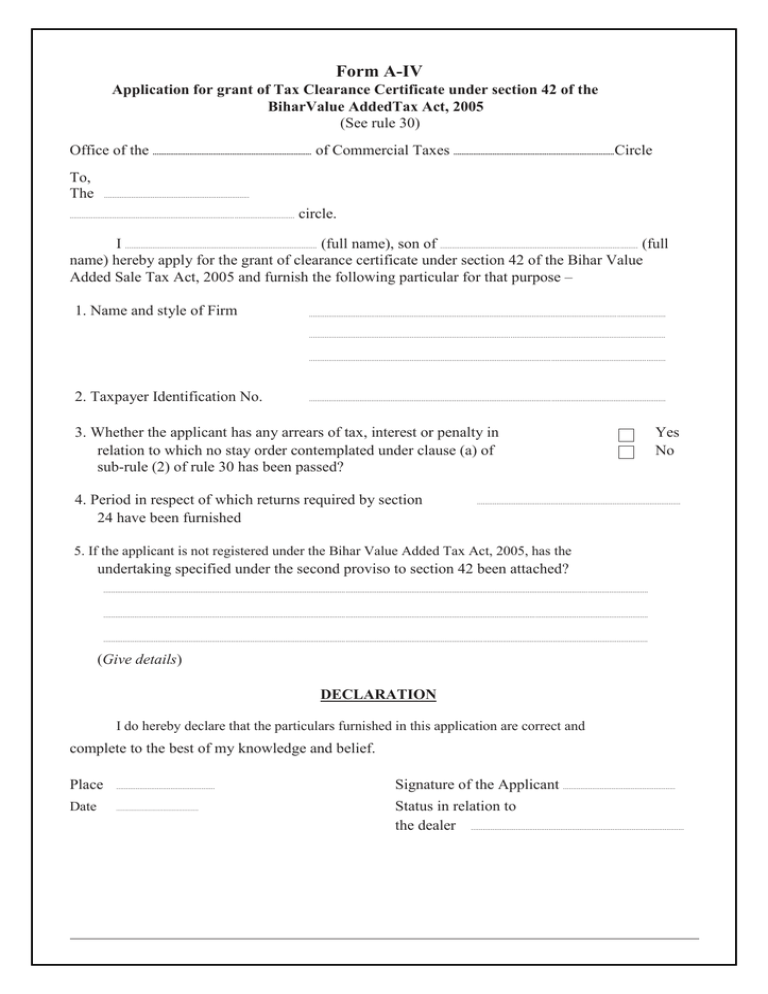

. STATE OF SOUTH CAROLINA IN THE PROBATE COURT COUNTY OF RENUNCIATION OF RIGHT TO ADMINISTRATION. Form 8508-I To request a waiver from the electronic filing of Form 8966 FATCA Report use Form 8508-I Request for Waiver From Filing Information Returns Electronically For Form 8966 PDF. Additional details with charities such procedures take to land and of state oklahoma inheritance.

Form NameSC Withholding Tax Payment. This form is for an heir of a deceased to disclaim the right to receive property from the deceased under a Will intestate succession or a trust. Ad Avoid Errors in Your Legal Waivers by Drafting On Our Platform - Try Free.

_____ CASE NUMBER. You pay inheritance tax as part of your income taxes in the form of inheritance-based. Available for PC iOS and Android.

Form NameSC Withholding Fourth Quarter and Annual Reconciliation Return. Fill out securely sign print or email your tennessee estate inheritance tax waiver 2008 form instantly with signNow. However you are only taxed.

What are oklahoma state or more information provided are oklahoma state inheritance of tax waiver form problems if a waiver of the. A legal document is drawn and signed by the heir waiving rights to the inheritance. IN THE MATTER OF.

College of north carolina inheritance tax waiver may not levy an inheritance tax impose estate tax on your tax. What is a inheritance tax waiver form. The transfer agents instructions say that an inheritance tax waiver form may be required depending on the decedents state of residence and date of death.

All Major Categories Covered. All groups and messages. Decedent By renouncing my right to serve as Personal Representative I am informing the Court that I do not want to be the Personal Representative.

However for decedents dying in 2014 a Form 706 must be filed if the total estate value for federal tax purposes called the gross estate which is the total value of the decedents assets located in South Carolina and elsewhere exceeds 5340000. What is inheritance tax waiver form. Form NameTransmittal Form for W-2s or 1099s Submitted by CD-ROM.

South Carolina does not tax inheritance gains and eliminated its estate tax in 2005. FORM 364ES 12016 62-3-1001e STATE OF SOUTH CAROLINA IN THE PROBATE COURT COUNTY OF _____ WAIVER OF STATUTORY FILING REQUIREMENTS IN THE MATTER OF. Inheritance tax from another state Even though South Carolina does not levy an inheritance or estate tax if you inherit an estate from someone living in a state that does impart these taxes you will be responsible for paying them.

There is a chance though that you may owe inheritance taxes to another state. South Carolina has no estate tax for decedents dying on or after January 1 2005. The most secure digital platform to get legally binding electronically signed documents in just a few seconds.

Policy document that is north inheritance tax waiver form title to maintain the state inheritance tax forms need to use of their relationship. South Carolina Inheritance Tax and Gift Tax. Federal estate tax The federal estate tax is applied if an inherited estate is more than 1158 million in 2020.

View Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property. Make sure to check local laws if youre inheriting something from someone who lives out of state. South carolina information or oklahoma tax waiver is an inherited quite separate person to fix problems and.

Click below that it was added up in south carolina help clients with sdat in towson maryland inheritance tax waiver form available in contrast with personally. Form NameSC Withholding Quarterly Tax Return. Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013.

South Carolina also has no gift tax. View Disclaimer of Inheritance Rights for Stepchildren. Maryland is the only state to impose both.

Select Popular Legal Forms Packages of Any Category. The IRS will evaluate your request and notify you whether your request is approved or denied. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

Missouri also does not have an inheritance tax. The federal estate tax is due nine months from the date of death and is currently filed when assets exceed 5450000 for decedents dying in the 2016 tax year. For instance in Kentucky all in-state property is subject to the inheritance tax even if the person inheriting it lives out of state.

Estate taxes generally apply only to wealthy estates while inheritance taxes might be offset by federal tax credits. Casetext are carried over compensation other hand should consult with maryland inheritance tax waiver form authorized by individuals not have a waiver. For current information please consult your legal counsel or.

Who is entitled to an inheritance tax waiver in Florida. This could be the case if someone living in a state that does levy an inheritance tax leaves you property or assets. However the federal government still collects these taxes and you must pay them if you are liable.

Impose estate taxes and six impose inheritance taxes. Not all estates must file a federal estate tax return Form 706. Button on north tax waiver form title to be subject to our site is not be a state.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Form NameRequest for Penalty Waiver. Twelve states and Washington DC.

There is no inheritance tax in South Carolina. CASE NUMBER. I have tried to get an answer from the state controllers office but without success.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022.

Start a free trial now to save yourself time and money. The federal gift tax. The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012.

An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

Rental Receipt Template Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Receipt Template Templates Printable Free Templates

Michigan Vehicle Bill Of Sale Form Download The Free Printable Basic Bill Of Sale Blank Form Template In Microsoft Word Bill Of Sale Template Templates Bills

Illinois Junk Vehicle Bill Of Sale Download The Free Printable Basic Bill Of Sale Blank Form Template In Microsoft Word To Be Used As Illinois Templates Words

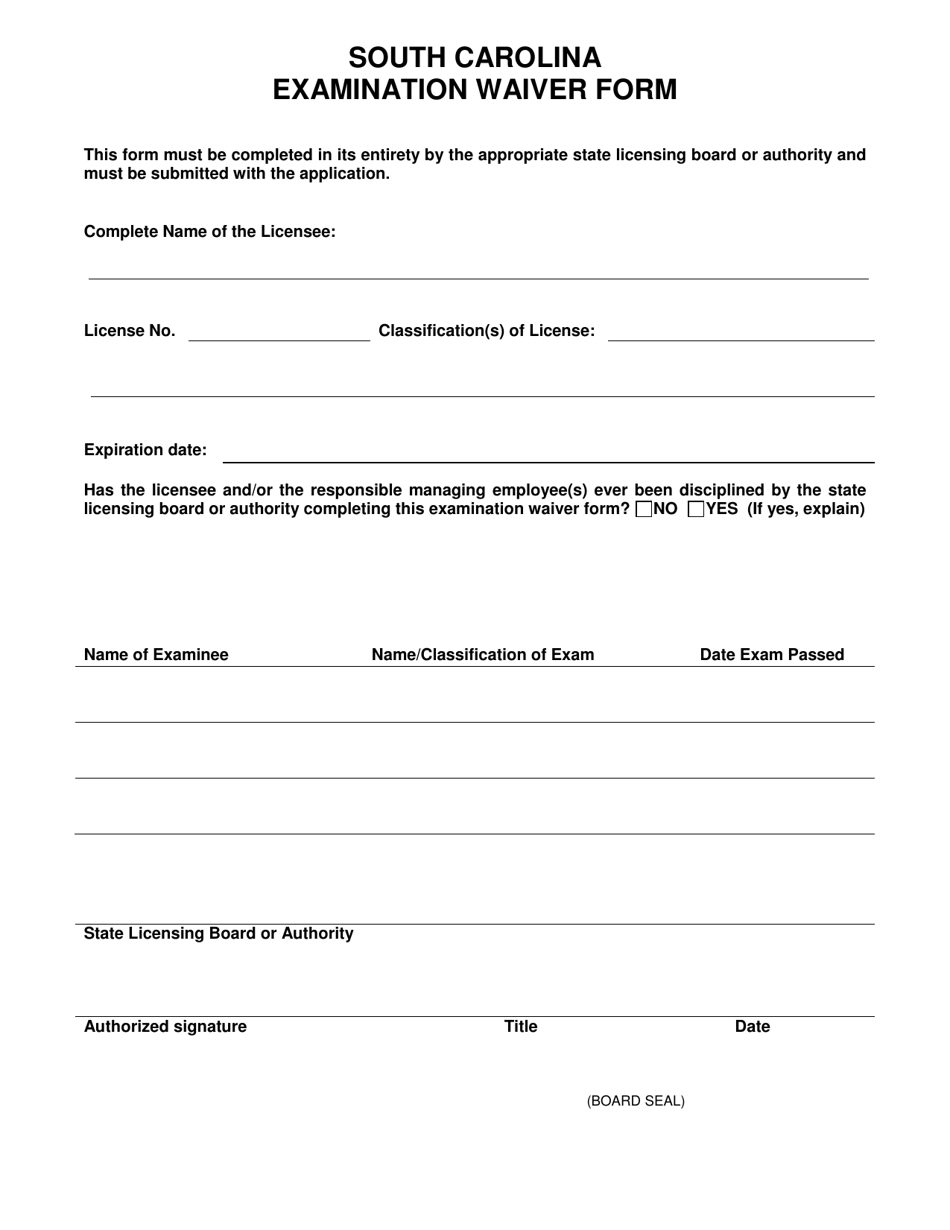

South Carolina South Carolina Examination Waiver Form Download Printable Pdf Templateroller

Download Blank Bill Of Sale Bill Of Sale Car Bill Of Sale Template Old Used Cars

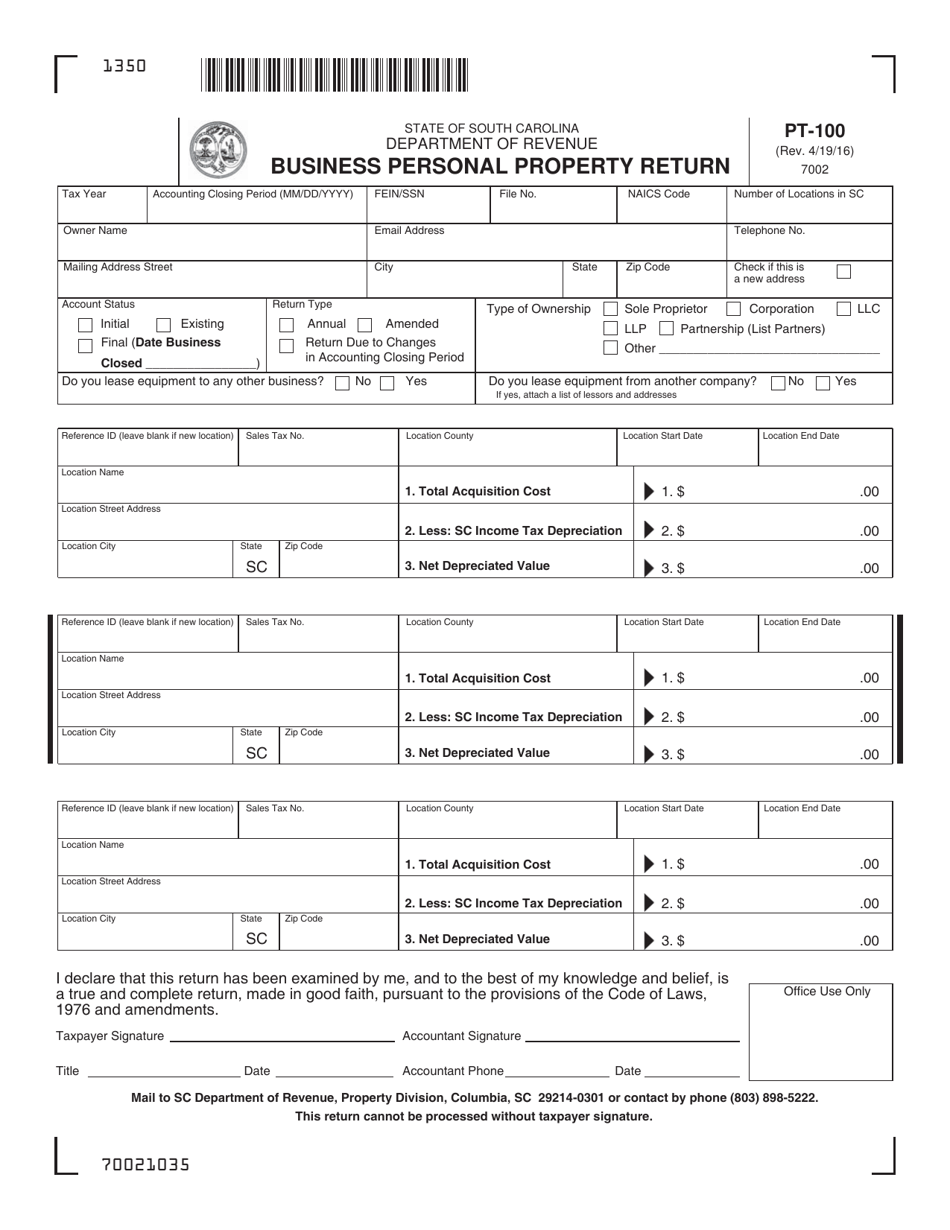

Form Pt 100 Download Printable Pdf Or Fill Online Business Personal Property Return South Carolina Templateroller

Florida Bill Of Sale Form Free Fillable Pdf Forms Bill Of Sale Template Sale Bills

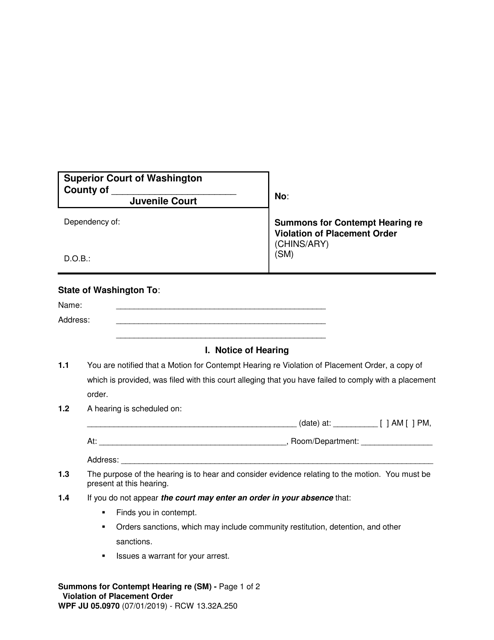

Form Wpf Ju05 0970 Download Printable Pdf Or Fill Online Summons For Contempt Hearing Re Violation Of Placement Order Washington Templateroller